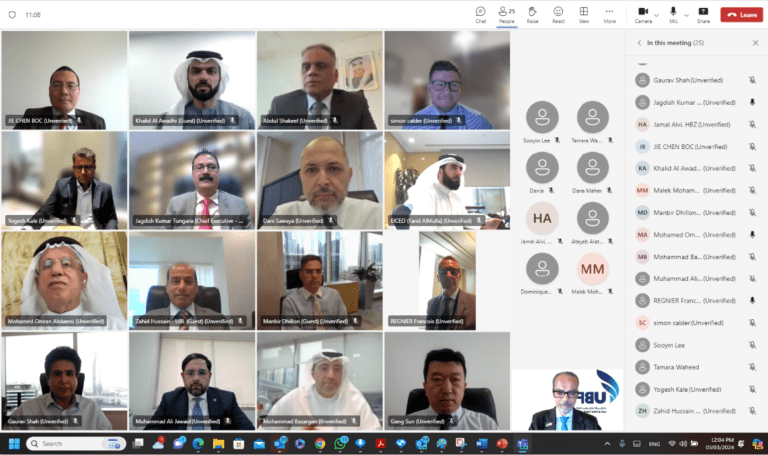

Abu Dhabi, United Arab Emirates; 25 March 2024: The CEOs Consultative Council of UAE Banks Federation (UBF), the sole representative and unified voice of banks in the UAE, recently held its first Consultative Council meeting for the year 2024 under the chairmanship of H.E. Mohammad Omran Al Shamsi, Vice Chairman of UAE Banks Federation and Chairman of the Board of Directors at RAKBANK, to discuss developments in the banking and financial sector and the plans that the Federation intends to implement in the current year as part of its efforts to consolidate the sector’s role in the economic development of the UAE.

At the meeting attended by the CEOs and general managers of UBF member banks, the progress made in implementing UBF strategy and plans over the past year and the significant achievements were discussed.

The participants also discussed the importance of accelerating the implementation of the Federation’s strategic plans, in addition to the development projects, seminars and workshops that are being conducted to keep pace with the rapid developments in the banking and financial sector to ensure that members adopt the best practices; and emphasised the importance of coordinating with the various UBF committees and developing banking processes.

H.E. Mohammad Omran Al Shamsi, Vice Chairman of UBF and Chairman of the CEOs Consultative Council, said: “The past year and the first quarter of 2024 have been marked by many achievements and the introduction of innovative initiatives by the Federation, under the direct supervision of the Central Bank of the UAE. These efforts are aimed at consolidating the UAE’s position as a global financial and banking hub. We at UAE Banks Federation are firmly committed to working with various strategic partners to continue the programmes and initiatives for continuous development of the financial sector.”

The participants of the meeting underscored the establishment of the “Sanadak” unit by the Central Bank of the UAE, which is the first independent unit specialised in resolving banking and insurance disputes in the Middle East and North Africa, stressing that it will enhance consumer confidence in the financial and banking sector and guarantee their rights efficiently and effectively.

The Consultative Council reaffirmed the Federation’s commitment to providing the “Sanadak” with the necessary support to enhance the efficiency and security of the financial and banking system to provide customers with the best means to resolve complaints or disputes related to banks and insurance companies licenced by Central Bank of the UAE with integrity, fairness and transparency. This will enhance customers’ ability to receive smooth and safe banking services that meet the highest international standards.

The CEOs Consultative Council meeting praised the UAE Banks Federation’s efforts to promote Emiratisation and the adoption of the Emiratisation Plan for the banking and financial sector under the direct supervision of the Central Bank of the UAE, which aims to create suitable conditions to attract, train and qualify Emirati talent and pave the way for future leaders in the banking and financial sector in cooperation with institutions and banks operating in the country.

The Council welcomed the decision of the Financial Action Task Force (FATF) in its February plenary meeting, reaffirming the effectiveness of UAE’s implementation of all AML/CFT framework recommendations. The FATF decision also reflects the efforts of various bodies in the UAE, particularly the UAE National Anti-Money Laundering and Combatting Financing of Terrorism and Financing of Illegal Organizations Committee and the Central Bank of the UAE. The Council also reaffirmed the UAE Banks Federation’s commitment to work under the UAE Central Bank’s guidelines to strengthen the UAE’s role in combating financial crime by complying with laws, regulations and supervisory and monitoring guidelines and adhering to the highest standards of corporate governance, transparency and risk management.

The CEOs Consultative Council meeting praised the UAE Banks Federation’s efforts to promote Emiratisation and the adoption of the Emiratisation Plan for the banking and financial sector under the direct supervision of the Central Bank of the UAE, which aims to create suitable conditions to attract, train and qualify Emirati talent and pave the way for future leaders in the banking and financial sector in cooperation with institutions and banks operating in the country.

The Consultative Council emphasised the importance of developing sustainable banking solutions in line with the UAE’s Net-Zero 2050 strategy, the Sustainable Development Goals and the COP28, which took place in the UAE last year. He pointed out that the UAE national banks’ pledge of one trillion dirhams (more than USD 270 billion) worth of sustainability plans and projects by 2030 reaffirms the banking sector’s commitment and its crucial role in supporting sustainable financing solutions and achieving SDGs.

During the meeting, Mr Jamal Saleh, Director General of UAE Banks Federation, gave an overview of the programmes, initiatives and annual plan for the year 2024, which aim to continue the development to support the leadership of the banking and financial sector in the UAE and to develop, adopt and adhere to the latest systems and policies, especially in terms of compliance, governance and transparency.

The Director General of the UAE Banks Federation said: “The achievements that the Federation has realised over the past year reflect the effective cooperation between its various components. The CEOs Advisory and Consultative councils assist members in creating a suitable platform to deepen the basis for participation in decision-making and benefit from the experience and knowledge of the members of the two councils and all specialised committees to further develop the banking and finance sector.

Under the guidelines of the Central Bank of the UAE, they enable members to launch innovative solutions that contribute to meeting the needs of customers and strengthen the UAE’s leading position as a global financial and banking hub.”