TECOM Group, a Dubai-listed company, is set to purchase the Office Park asset located in Dubai Internet City from Emirates REIT for AED 720 million ($196 million). This deal comes as Emirates REIT faces an approaching sukuk payment deadline.

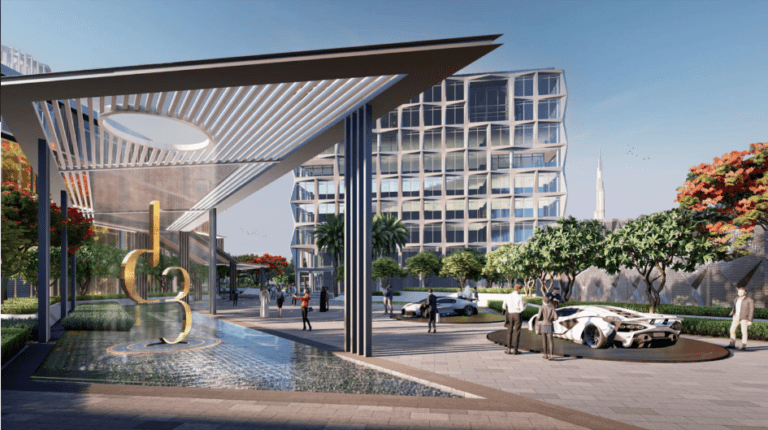

The acquisition will involve five Grade A commercial buildings and is contingent on approval at Emirates REIT’s upcoming extraordinary general assembly. The memorandum of understanding (MOU) for this transaction was signed between TECOM Investments FZ LLC, a subsidiary of TECOM Group, and Emirates REIT.

Emirates REIT has been under pressure to manage its financial commitments, having already exercised a one-year extension on a $380 million bond, which was last refinanced in 2022.

A partial redemption of the bond, reducing the outstanding amount to $230 million, is due in December 2024.

Earlier this year, Emirates REIT took steps to reduce its financial liabilities. In August, the company partially redeemed its sukuk following the sale of Trident Mall in Dubai’s Jumeirah Beach Residence (JBR). This reduced the outstanding amount to $304.73 million.

Office Park, a high-profile commercial asset, has been part of Emirates REIT’s portfolio since 2012, following its acquisition from Dubai Properties LLC in exchange for a stake. The buildings host prominent global companies such as Coca-Cola, Uber, Red Hat, and Ticketmaster, and have consistently attracted high occupancy rates.

TECOM Group highlighted the strong performance of Dubai’s commercial real estate sector, noting that increasing demand is driving up occupancy rates and rental prices. “The Dubai commercial and industrial real estate segment continues to demonstrate robust growth, which is driving occupancy rates higher and leading to a notable increase in rental rates,” TECOM said in a statement to the Dubai Financial Market (DFM).

Emirates REIT confirmed that part of the net proceeds from the sale will be used to redeem its secured sukuk certificates, issued on December 12, 2022, aligning with its de-leveraging strategy. “Following the recent sale of Trident Grand Mall in July, this transaction is part of Emirates REIT’s ongoing de-leveraging strategy, taking advantage of current favorable market conditions,” the REIT stated.

This sale is seen as a significant step in helping Emirates REIT meet its financial obligations and continue its strategy of reducing debt while capitalizing on Dubai’s booming real estate market.