The high levy comes after the billionaire exercised almost 15 million options and sold millions of shares.

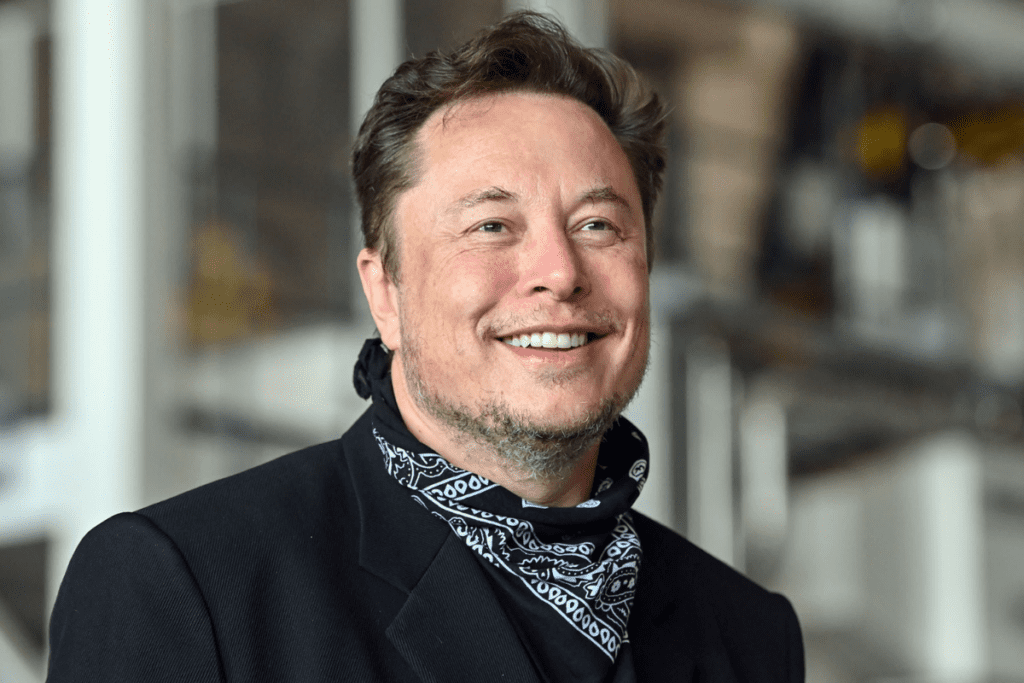

Elon Musk, co-founder and chief executive of electric vehicle maker Tesla, took to Twitter to say he will pay more than $11 billion in taxes this year amid criticism that the world’s wealthiest person isn’t paying enough.

Mr Musk, who is worth $243bn on the Bloomberg Billionaires Index, may indeed face a tax bill of more than $10bn for 2021 if he exercises all his options due to expire next year, according to Bloomberg News.

The bill comes after Mr Musk exercised almost 15 million options and sold millions of shares to cover the taxes related to those transactions.

The billionaire businessman has been offloading his shares, selling stock worth nearly $14bn over the past few weeks after conducting a Twitter poll on whether he should sell 10 per cent of his stake in the EV maker. Tesla’s shares have surged more than 2,300 per cent over the past five years. It was flat in after-hours trading.

At the 2021 Code Conference in September, Mr Musk revealed that he intended to sell a huge portion of his stock in the fourth quarter. In the same month, he established a pre-arranged trading plan to carry out “an orderly sale of shares related to the exercise of stock options”, filings show. However, the November 6 Twitter poll did not disclose the existence of that plan.

Mr Musk proposed this move, citing discussions about wealthy people hoarding unrealised gains to avoid paying taxes.

Mr Musk, named by Time magazine as its Person of the Year last week, is now about two thirds of the way through trimming 10 per cent of his direct share ownership in Tesla. If the threshold he has referred to includes exercisable options, he will need to get rid of approximately another six million shares.

On December 10, Mr Musk joked about quitting his job and “becoming an influencer full-time”, when he offloaded shares worth $963 million to pay taxes on the exercise of an additional 2.2 million options.

However, shareholders and regulators have not always appreciated the humour in Mr Musk’s tweets. Tesla shares plunged after a post in jest on April Fool’s Day in 2018, claiming the company had gone bankrupt.

Later that year, the US Securities and Exchange Commission sued him over tweets about taking Tesla private.

But Mr Musk’s tweets are also highly influential in the market, especially when he comments on cryptocurrencies. In May, Bitcoin tanked as much as 17 per cent after the billionaire said Tesla suspended the use of the world’s largest cryptocurrency over environmental concerns.

Mr Musk’s latest move comes as he tackles US Democrats’ “billionaires’ tax”, which seeks contributions from America’s most affluent by taxing their “tradable assets”.

The proposed tax is expected to help fund US President Joe Biden’s ambitious social policy and climate change legislation.

Last week, US senator Elizabeth Warren tweeted to say that Mr Musk should pay taxes instead of “freeloading off everyone else”.

The Tesla chief executive responded by saying that he “will pay more taxes than any American in history this year”.

A report by ProPublica in June said that Mr Musk paid little income tax relative to his vast wealth. His fortune has grown by $110bn this year, according to the Bloomberg Billionaires Index.

But he has hit back, saying he does not draw a salary from either SpaceX or Tesla, and pays an effective tax rate of 53 per cent on stock options he exercises. He added that he expects that tax rate to increase next year.

(Except for the headline, this story has not been edited by The Finance World staff and is published from a syndicated feed.)