The UAE has confirmed a nationwide shift to mandatory e-invoicing under its new Electronic Invoicing System (EIS). The transition begins with a pilot phase in July 2026, followed by staged implementation for all VAT-registered businesses from 2027. This move places the UAE among the global leaders modernizing tax infrastructure through real-time digital reporting.

At a Glance: What UAE Businesses Must Know

• The e-invoicing mandate covers all VAT-registered businesses engaging in B2B and B2G transactions.

• B2C transactions and certain exempt industries are currently outside the scope.

•Large businesses with annual revenue of AED 50 million or more must onboard an Accredited Service Provider (ASP) by 31 July 2026 and fully adopt e-invoicing by 1 January 2027.

•Only structured digital formats – XML or JSON (UBL or PINT standards) will be accepted. PDFs and paper invoices will no longer be valid.

•The Federal Tax Authority (FTA) will receive, record, and monitor all e-invoices via its e-Billing System.

What E-Invoicing Means in the UAE

E-invoicing involves creating, transmitting, and storing invoices electronically in a machine-readable, structured format, replacing PDFs and manual formats. Under the EIS, every e-invoice must:

• Be issued in an approved digital format (XML/JSON using UBL or Peppol PINT).

•Pass through an FTA-approved ASP using the Peppol-aligned “5-corner” model.

•Be stored within the FTA’s e-Billing repository for audit and compliance tracking.

•Exclude any unstructured or manually generated documents such as PDFs, paper invoices, scans, or images.

Core Compliance Requirements

Businesses subject to the mandate must adhere to the following rules:

• Digital formats only: Invoices and credit notes must be issued digitally in XML or JSON.

• Standardized structure: UBL or PINT standards are compulsory.

• Transmission via ASP: All invoices must be routed through an accredited provider for validation and delivery.

• 14-day reporting window: E-invoices and credit notes must be transmitted within 14 days of the transaction date.

• Mandatory data dictionary fields: All required fields – supplier data, TRN, VAT breakdown, timestamps, digital signatures, etc. must be included.

• Electronic credit notes: These must follow the same structure and process as invoices.

• Domestic data storage: All e-invoice records must be stored within UAE borders.

• Failure reporting: Technical issues must be reported to the FTA within two business days.

How the E-Invoicing Process Works

The e-invoicing workflow is fully digital and integrates business systems with ASPs and the FTA:

• Appoint an ASP: Businesses must engage an accredited service provider to configure ERP systems and ensure adherence to the FTA data dictionary.

• Map Data Fields: Seller, buyer, VAT details, item classifications, and totals are mapped to FTA-defined fields.

• Format Conversion: The ASP converts invoice data into XML or JSON using approved standards.

• Validation: The invoice undergoes schema checks and data enrichment (e.g., identifiers, codes, signatures).

• Real-Time Transmission: The ASP sends the invoice simultaneously to:

• The FTA’s e-Billing system

• The buyer’s ASP

• Secure Storage: Both parties must retain invoices electronically within the UAE for audit and VAT filing purposes.

e-Invoicing Framework: The UAE’s “5-Corner” Model

The UAE uses a Peppol-aligned Continuous Transaction Controls framework, involving:

• Issuer (Supplier)

• Receiver (Buyer)

• FTA E-Billing System (central repository)

• Sender ASP.

• Receiver ASP

The FTA acts as a repository but does not validate invoice content; this responsibility lies with ASPs. All VAT-registered persons conducting taxable B2B and B2G transactions.

Exemptions

The following categories are not required to issue e-invoices:

• B2C transactions

• Government activities performed in a sovereign capacity

• International passenger air travel (e-ticketed)Airline ancillary services covered by EMDs

• International goods transport by air (exempt for 24 months from system go-live)

• VAT-exempt and zero-rated financial services

• Any additional cases the Minister of Finance may specify

Role of Accredited Service Providers

ASPs are at the core of the UAE’s digital invoicing ecosystem. Their responsibilities include:

• Mapping ERP/accounting data to FTA formats

•Validating invoices against technical and VAT rules

• Enriching data with mandatory Fields

• Converting internal formats into XML/JSON

• Real-time transmission to FTA and buyers

• Digital signatures, encryption, and security

• Integration support (APIs, middleware, onboarding)Storage and archiving within the UAE

• Monitoring, notifications, and downtime procedures

How Businesses Should Prepare Before July 2026

• Review the timelines and determine applicability based on revenue and transaction type.

•Select an accredited ASP and complete onboarding well ahead of deadlines.

• Upgrade ERP/accounting systems to generate structured invoice data and support digital signatures.

• Participate in the pilot window (July–December 2026) to test integration and workflows.Develop compliant data storage practices within the UAE.

• Train finance and compliance teams for real-time VAT reporting and system contingency procedures.

Why the UAE Is Launching E-Invoicing

The introduction of the system supports the UAE’s digital-first economic vision by:

• Enhancing tax transparency and reducing fraud

• Bringing real-time or near-real-time visibility into taxable transactions

• Reducing administrative burden

• Increasing accuracy in VAT reporting

• Improving efficiency across supply chains

• Supporting integration with global trade and invoicing standards

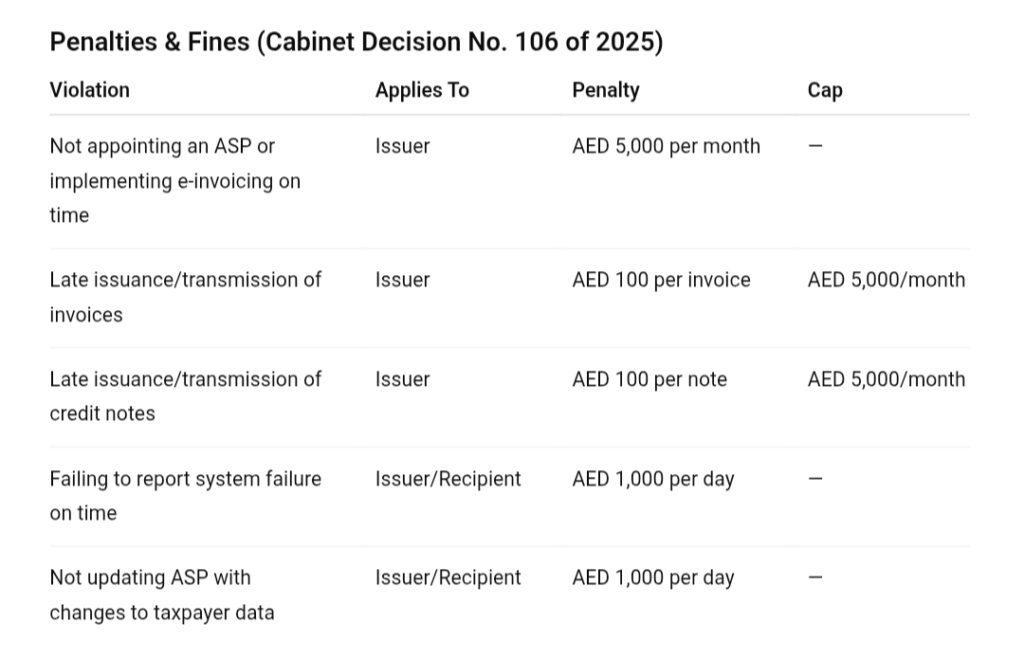

The UAE’s e-invoicing mandate marks one of the country’s most significant regulatory transformations in recent years. With the first phase beginning in July 2026, businesses must start preparing now to avoid delays, ensure smooth adoption, and prevent costly penalties.

Companies that embrace the system early will benefit from better efficiency, enhanced compliance, and stronger alignment with the UAE’s rapidly digitizing economy.