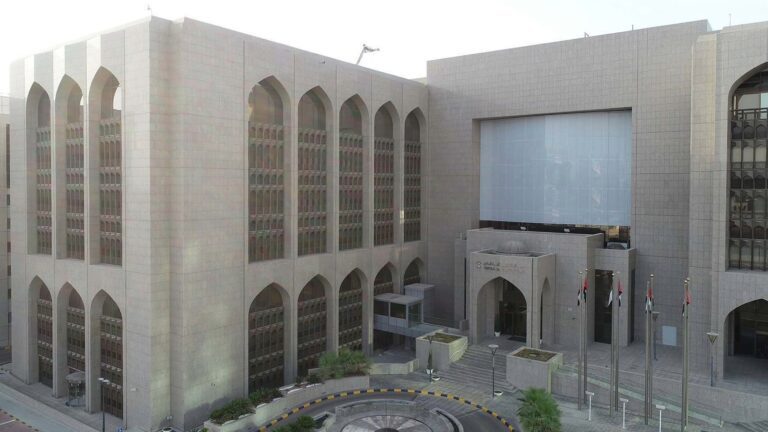

The Central Bank of the UAE (CBUAE) announced on Monday (August 18) that it has suspended the licence of YAS Takaful PJSC after the company failed to meet regulatory requirements applicable to insurance providers in the country.

Although its licence has been suspended, YAS Takaful is still legally required to honour all obligations under insurance contracts that were issued prior to the enforcement of this measure.

The action was taken pursuant to Article 33(2)(k) of Federal Decree Law No. 48 of 2023, the legislation governing insurance operations within the UAE.

The CBUAE reaffirmed that, under its supervisory and regulatory responsibilities, it is committed to ensuring that insurers, their shareholders, and employees comply with UAE laws, as well as the regulations and standards it adopts to preserve the integrity of the insurance sector and the broader financial system.

Earlier, on July 11, the Central Bank had suspended the licence of Al Khazna Insurance Company for failing to satisfy licensing criteria required to continue conducting insurance activities during the suspension period.

In March, the regulator imposed penalties amounting to AED 2.62M on two insurance firms and five banks for breaches related to tax compliance standards.

The UAE has continued to tighten oversight of its banking, financial, and insurance industries, reinforcing adherence to both domestic legislation and international regulatory frameworks.