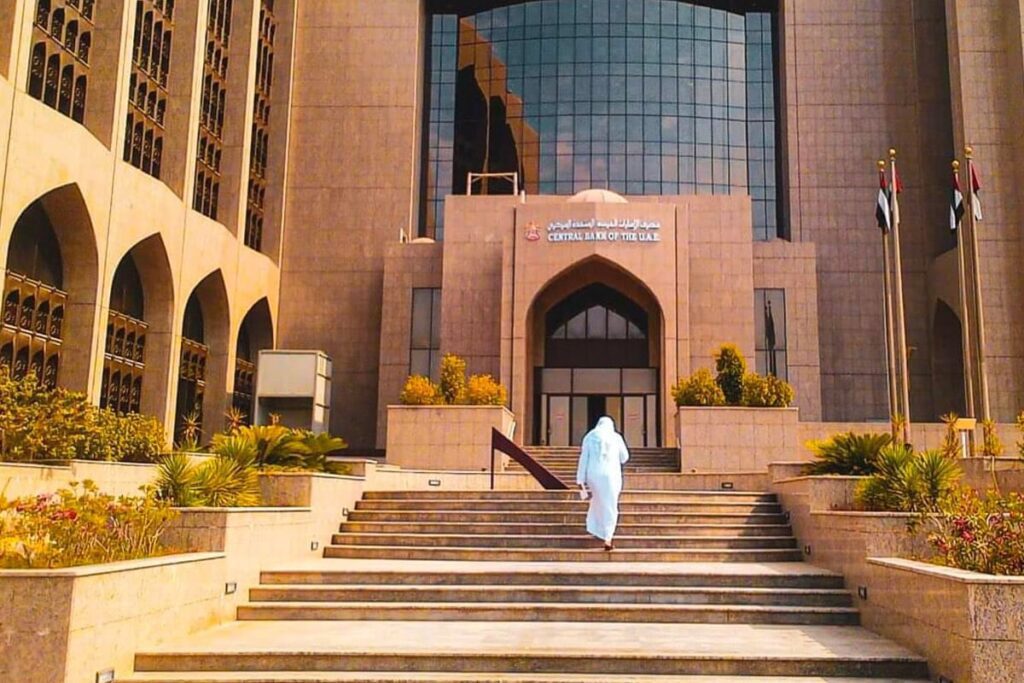

UAE Central Bank Responds to US Federal Reserve’s 22-Year High-Interest Rate by Raising Benchmark Rate

In light of the US Federal Reserve’s move to increase its key interest rate to the highest level in 22 years, the UAE Central Bank has taken action by raising its benchmark borrowing rate. The Federal Reserve has been on a monetary tightening cycle since March 2022, and this recent increase marks the 11th time the policy rate has been raised.

The Fed’s decision to raise rates aims to combat inflation and restore price stability, with the goal of bringing inflation down to its target range of 2 per cent. Despite inflation slowing in June, it still remains a concern, especially with strong wage growth reported in the previous month.

As many central banks in the GCC peg their currencies to the US dollar, they often follow the Fed’s policy rate moves. The UAE Central Bank raised its base rate for the overnight deposit facility by a quarter of a percentage point to 5.4 per cent, and it maintained the rate applicable to borrowing short-term liquidity at 50 basis points above the base rate.

The UAE economy experienced significant growth in recent years, driven by the non-oil sector, with a 7.9 per cent growth rate in the previous year. However, inflation in the Emirates, driven by increasing energy prices, imported inflation, and rising employment, reached 4.8 per cent in 2022. The Central Bank projects inflation to be at 3.1 per cent in 2023 and 2.6 per cent in 2024, reflecting lower energy and food prices.

Global inflation is expected to fall to 6.8 per cent this year and 5.2 per cent in 2024, according to the International Monetary Fund’s estimates, still above the 2 per cent target of many central banks.

Despite tighter global financial conditions, the UAE’s non-hydrocarbon real growth is expected to remain strong at 4.8 per cent this year. Moody’s Analytics predicts a slowdown in the US economy, but the IMF estimates global growth to be around 3 per cent for this year and 2024.

Overall, the UAE Central Bank’s decision to raise the benchmark rate reflects its commitment to addressing economic challenges posed by inflation and aligning its monetary policy with the US Federal Reserve’s actions.