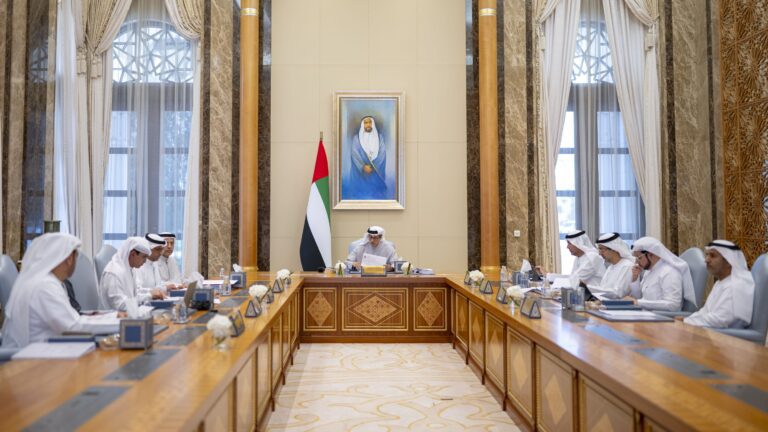

His Highness Sheikh Mansour bin Zayed Al Nahyan chaired a meeting of the Board of Directors of the Central Bank of the United Arab Emirates at Qasr Al Watan in Abu Dhabi. Moreover, the session was attended by the Vice Chairmen of the Board, Abdulrahman Al Saleh and Jassem Mohammed Bu Ataba Al Zaabi, alongside Governor Khaled Mohamed Balama.

Board members Younis Haji Al Khoori, Sami Dhaen Al Qamzi, and Dr. Ali Mohammed Al Rumaithi were present. Additionally, the meeting was attended by Assistant Governors Ahmed Saeed Al Qamzi, Saif Humaid Al Dhaheri, and Ibraheem Al Sayed Al Hashemi, Assistant Governor for the Executive Office and Secretary General of the Board.

Opening the meeting, Sheikh Mansour welcomed attendees and praised the Central Bank’s achievements during 2025. Therefore, he highlighted their contribution to the development of the UAE’s financial sector and the country’s position as a global financial hub.

Financial stability and digital transformation

Sheikh Mansour emphasised that the Central Bank continues to advance in line with leadership directives. Moreover, he noted progress in implementing strategies that strengthen financial stability, enhance system efficiency, and support digital transformation.

The Board reviewed the agenda, assessed 2025 achievements, and examined progress on transformational projects. Consequently, discussions covered banking operations and support services, including the International Central Securities Depository project and the Real Time Gross Settlement system. The Board also approved the Central Bank’s estimated budget for 2026.

Payments, regulation, and Emiratisation

The Board was updated on Emiratisation progress in the financial sector. As a result, members noted that 95 per cent of the targets under the “Ithraa” Emiratisation Programme for 2023–2026 were achieved through the recruitment of 9,754 UAE nationals.

Updates were also provided on several central banks joining the “Jisr” platform for central bank digital currencies and its interlinking with the UAE’s Instant Payment Interface and the domestic card scheme Jaywan. Therefore, these initiatives aim to facilitate cross-border payments, reduce transaction costs, and enable instant settlement, supporting plans to expand participation in 2026.

The Board reviewed regulatory and legislative development plans for banking and insurance. Additionally, it approved three new regulations covering insurance licensing, insurance brokers, and telemarketing, in line with Cabinet Resolution No. 56 of 2024, to enhance consumer protection and market efficiency.

Reports from Central Bank departments were discussed, and appropriate decisions were taken. Consequently, these measures support priorities for the next phase and further strengthen the UAE’s financial system.