National Bonds, the UAE’s top Sharia-compliant savings and investment company, has reported a 67% increase in regular savers following the relaunch of its mobile app. The results, measured over the three months since launch, show clear progress in the company’s digital journey.

The numbers highlight strong growth. Fixed-term savings plans rose by 149%, while new customer sign-ups jumped 31%. Transactions increased by 31%, and sales climbed 40%. These figures reveal a growing demand for fast, smart, and easy ways to save.

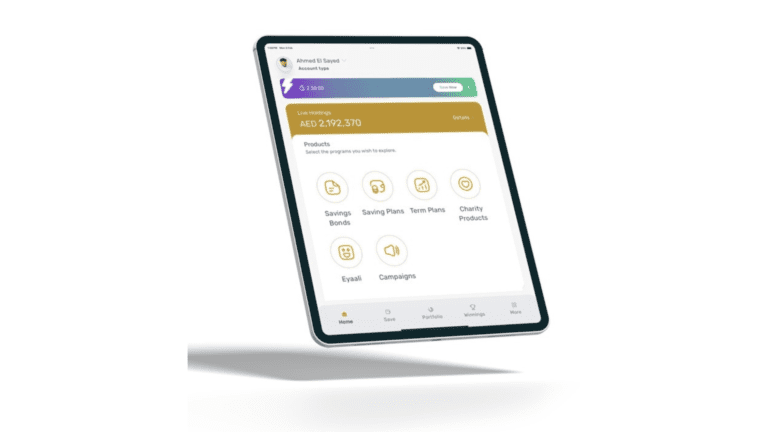

Redesigned App Focuses on Simplicity and Results

The updated app includes an improved interface, faster navigation, and user-friendly tools. Now, customers can track savings, view profit estimates, and manage fixed-term plans with ease. Users can also connect with relationship managers for real-time support.

At the core of these changes is a simple idea: people want more control over their finances. National Bonds has responded by creating a smoother, smarter experience.

Commenting on the success, Rehab Lootah, Deputy Group CEO of National Bonds, said:

“This growth in digital adoption is more than just a trend, it’s a powerful validation of our customer first strategy. We’ve always placed the customer at the heart of every innovation, and the enhanced app is a direct reflection of that ethos. By blending simplicity, intelligence, and accessibility, we’re helping individuals take greater control of their financial futures. As we continue to invest in AI-enabled, user-focused solutions, we remain committed to delivering intuitive, secure, and inclusive financial tools, fully aligned with the UAE’s broader digital transformation and responsible AI vision.”

Supporting the UAE’s Digital and Financial Future

With digital adoption growing across the UAE, National Bonds is helping more people save consistently. The relaunch is not just a tech upgrade. It is part of a bigger mission to build a secure and inclusive future for all residents.

By combining smart tools with Sharia-compliant values, the company is setting new standards in financial empowerment. This success reflects both National Bonds’ long-term strategy and the UAE’s vision for a tech-driven, financially secure society.