Biggest in the region was Aramco Gas Pipelines Company’s $15.5bn deal.

The value of mergers and acquisition deals in the Middle East and North Africa surged 57 per cent to reach $109.1 billion last year as the region’s economies recovered from the coronavirus pandemic.

The total number of deals also jumped 40 per cent annually to reach 1,141, which is the highest annual total recorded since 1980, according to a new report from Refinitiv.

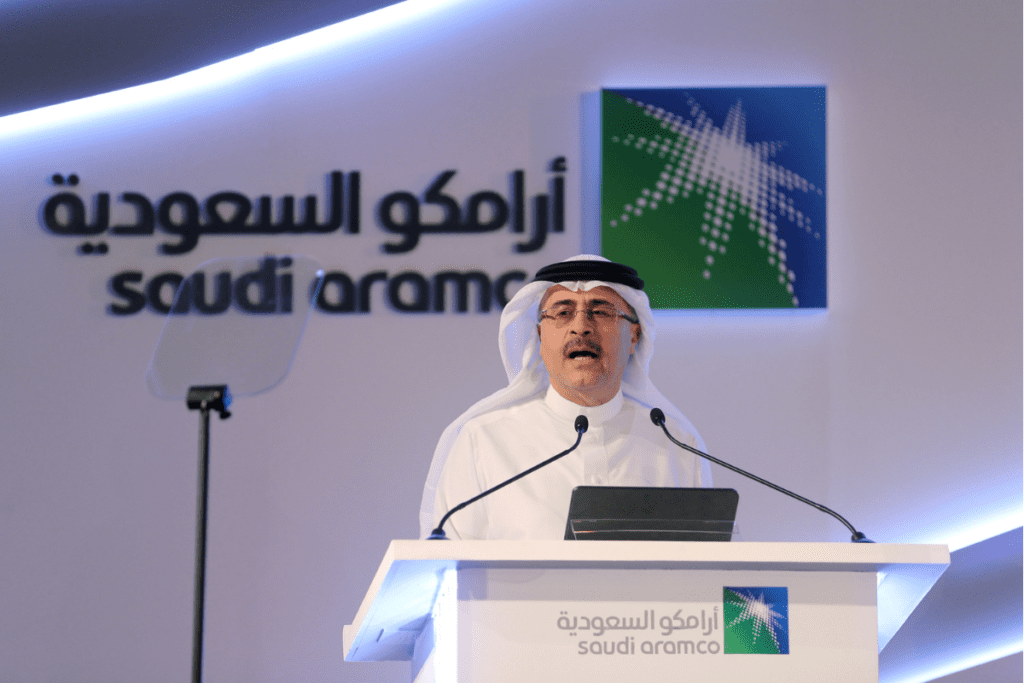

“The largest M&A deal in the Mena region of 2021 was Aramco Gas Pipelines Company in a deal worth $15.5bn lease and leaseback agreement for its gas pipeline network,” the report said.

A group of companies led by BlackRock Real Assets and state-backed Hassana Investment Company was involved in the Aramco transaction. Aramco Gas Pipelines Company is a subsidiary of Saudi Aramco, the world’s largest oil exporting company.

Inbound mergers and acquisition deals jumped 88 per cent to reach $45.4bn, while outbound deals rose 198 per cent to touch $30.2bn, a six year high. Saudi Arabia was the most targeted nation with $27.3bn in total deals, while energy and power was the most active sector with deals worth $38.8bn, the data showed.

“2021 was the first year M&A with any Mena involvement surpassed 1,000 deals demonstrating growing optimism in the region,” Saiem Jalil, deals intelligence analyst at Refinitiv, said.

“Strong recovery in business performance throughout 2021 demonstrated a return for capital markets driving momentum, contributed by ECM (equity capital markets) proceeds up 193 per cent to $14.5bn and investment-grade corporate debt at record levels with $66bn in proceeds.”

The largest equity offering of the year was Saudi Telecom’s follow-on issuance of $3.2bn after the Public Investment Fund sold six per cent of its stake. Saudi Arabia was the most active country with $8.9bn in total proceeds, followed by the UAE at $4.3bn.

Investment banking fees in the Mena region increased 3 per cent to $1.4bn in 2021 during the period, according to Refinitiv.

Gulf economies grew 2.3 per cent in 2021 on the back of higher oil prices and fiscal stimulus measures, following a 4.9 per cent contraction the previous year when the pandemic began, Dubai’s biggest lender by assets said in a recent report. The countries are forecast to grow 5.1 per cent on average this year.

(Except for the headline, this story has not been edited by The Finance World staff and is published from a syndicated feed.)