The conglomerate plans to issue US dollar-denominated bonds in one or more tranches.

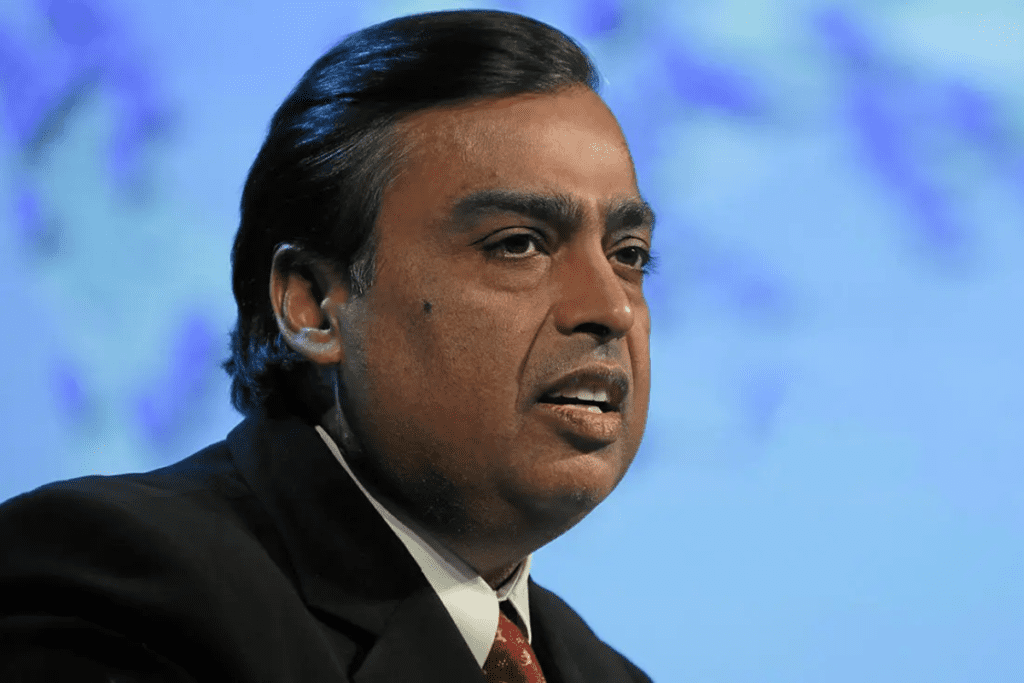

Reliance Industries, the Indian conglomerate controlled by billionaire Mukesh Ambani, is aiming to raise as much as $5 billion through the issuance of bonds to refinance its existing debt.

The US dollar-denominated senior unsecured notes will be issued in one or more tranches, Reliance said in a statement to the Bombay Stock Exchange, where its shares are traded.

“The proceeds from the issuance of the notes will be utilised primarily for refinancing of existing borrowings, in accordance with the applicable law,” the company said after its board meeting on Saturday.

Sovereign borrowers, government related entities and corporate issuers are looking to tap into international debt markets to take advantage of low interest rates prevailing globally. Abu Dhabi Ports raised $1bn through the issuance of a 10-year bond last year. First Abu Dhabi Bank and other regional financial institutions and corporate borrowers also issued bonds in 2021.

The latest announcement from Reliance comes as it looks to expand its operations globally to boost growth. Last year, it formed a wholly owned subsidiary in the UAE that will trade oil, petroleum, petrochemical products and agricultural commodities.

The new unit, Reliance International Limited, will be incorporated within the Abu Dhabi Global Market, the company said in October.

It is also setting up a joint venture with the Abu Dhabi Chemicals Derivatives Company, better known as Ta’ziz, to develop a major chemicals project at the Ta’ziz industrial chemicals zone in Ruwais.

The joint-venture, Ta’ziz EDC & PVC, will construct and operate a chlor-alkali, ethylene dichloride and polyvinyl chloride (PVC) plant with an investment of more than $2bn, Adnoc said in December.

The Ta’ziz Industrial Chemicals Zone is a joint venture between Adnoc and Abu Dhabi’s ADQ.

The Indian conglomerate, which has interests from retail to oil, is also pivoting towards renewable energy as it aims to become carbon neutral by 2035. Its renewable subsidiary, Reliance New Energy Solar, is investing $144m in US energy storage company Ambri along with other investors, including Paulson & Co and US billionaire Bill Gates.

Last week, RNES purchased UK’s Faradion, a sodium-ion battery technology company, for an enterprise value of £100m (135.23m), marking the company’s sixth green deal.

Reliance also bought a stake in a high-end fashion brand, owned by Indian fashion designer Manish Malhotra last year as part of its expansion plans.

Reliance Industries’ net profit in the three months ending September 30 surged 43 per cent to 136.8bn rupees ($1.83bn) as revenue grew by 50 per cent a year to 1.74 trillion rupees. The company recorded growth across all its business units during the period.

(Except for the headline, this story has not been edited by The Finance World staff and is published from a syndicated feed.)