Most Gulf central banks have reduced their key interest rates by 25 basis points, mirroring the U.S. Federal Reserve’s latest move to cut rates for the second time this year. The decision reflects the region’s close monetary alignment with the dollar, as most Gulf currencies remain pegged to the U.S. currency — with the exception of the Kuwaiti dinar, which is tied to a basket of currencies.

The Federal Reserve on Wednesday trimmed its benchmark rate by a quarter percentage point, a decision that drew dissent from two policymakers. However, Fed Chair Jerome Powell emphasized that any further cut in December remains “far from a foregone conclusion,” signaling a cautious approach to monetary easing.

Saudi Arabia and UAE Lead Regional Reductions

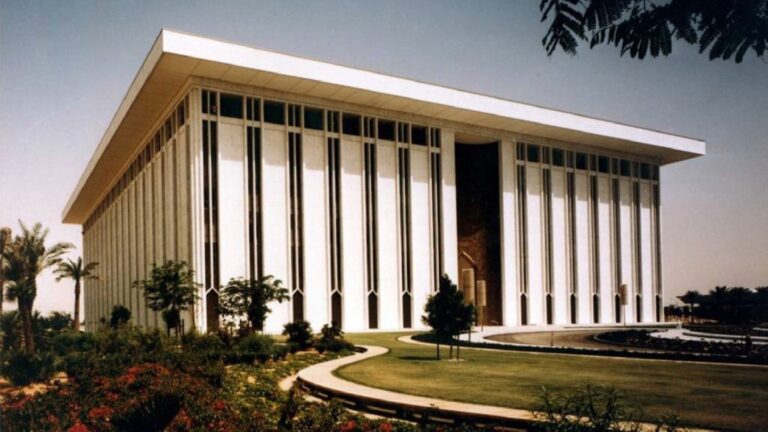

The Saudi Central Bank (SAMA), overseeing the region’s largest economy, lowered its repurchase agreement (repo) rate by 25 basis points to 4.50%, and its reverse repo rate to 4.00%. The Central Bank of the United Arab Emirates followed suit, cutting the base rate on its overnight deposit facility to 3.9%, effective Thursday.

Meanwhile, the central banks of Qatar, Bahrain, and Oman also aligned with the Fed’s move, trimming their benchmark rates by 25 basis points. In contrast, the Central Bank of Kuwait opted to hold rates steady, noting that its monetary policy stance remains appropriate given domestic economic conditions.

Lower Rates to Support Gulf Economic Diversification

While inflation continues to challenge major global economies, the Gulf Cooperation Council (GCC) states remain relatively shielded. Analysts expect that easing borrowing costs will stimulate private-sector growth and support diversification initiatives away from oil dependency.

Across the region, governments are investing heavily in real estate, tourism, manufacturing, and renewable energy, with lower interest rates likely to enhance access to financing and boost non-oil GDP growth. As Gulf economies balance reform and fiscal prudence, synchronized rate cuts are viewed as a strategic step toward maintaining liquidity and long-term economic momentum.