du Pay, the digital financial services unit of telecom operator du, has recorded more than AED 1.5 billion in transactions in under two years. The company says this achievement reflects both its rapid expansion and the UAE’s wider move towards a cashless economy.

The platform was introduced to offer accessible, banking-style services for residents who may not qualify for traditional accounts. It has gained significant traction among the UAE’s varied expatriate community.

du Pay stated that its services align with the Dubai Department of Finance’s goal to ensure that 90 per cent of all transactions in the emirate become cashless by 2026.

Fahad Al Hassawi, chairman of du Pay, said that surpassing AED 1.5 billion in transactions demonstrates the company’s dedication to financial inclusion and digital transformation in the UAE. He added that the aim is to help residents take part fully in the digital economy by offering comprehensive digital payment solutions that support the nation’s cashless vision.

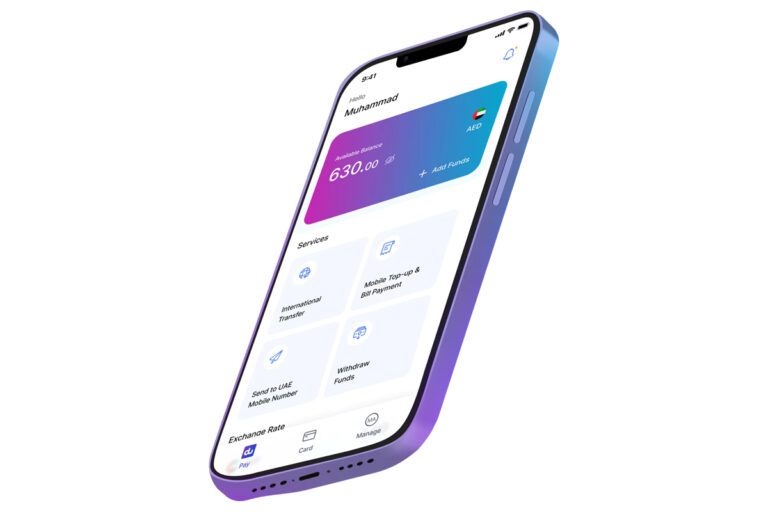

The company promotes du Pay as a straightforward, secure and inclusive tool for financial management. Users can register instantly using Emirates ID and facial recognition, access the app in several languages and carry out everyday financial activities without facing the usual challenges of traditional banking.

The service gives customers a free IBAN, allowing salary transfers through local banks, and it does not require any minimum balance.

du Pay reported that the app has been downloaded more than one million times and supports a wide range of services, including payments, mobile top-ups, utility bill payments and cardless cash withdrawals. The platform also enables international transfers to more than 200 countries at competitive rates, highlighting its focus on meeting the remittance needs of expatriate workers.

The company points to its Central Bank of the UAE licence and its strong security framework as essential in gaining the confidence of new users. It added that promotional offers, such as free mobile data on recharges or international transfers and gold coin rewards, have encouraged greater engagement. More than 300 customers have already received gold coins.