Emirates Integrated Telecommunications Company Sets Stage for UAE’s Largest Secondary Offering of 2025

Emirates Integrated Telecommunications Company PJSC, operating under the “du” brand, represents one of the UAE’s two licensed public telecommunications operators and is currently launching a significant secondary public offering through the Dubai Financial Market. The offering, dated September 8, 2025, involves the sale of up to 342,084,084 shares (representing 7.5467% of total issued shares) by Mamoura Diversified Global Holding PJSC, with shares priced between AED 9.00 and AED 9.90 per share.

This secondary offering comes at a time when du has demonstrated exceptional financial performance, with the company achieving record-breaking revenue of AED 14.6 billion in 2024, representing a 7.3% year-over-year increase. The telecommunications giant has successfully positioned itself as a formidable competitor in the UAE’s duopoly market structure, consistently gaining market share against the incumbent operator e& (formerly Etisalat).

Executive Summary

Offering Highlights:

- Total Shares Offered: 342,084,084 shares (7.55% of du’s share capital)

- Price Range: AED 9.00 – AED 9.90 per share

- Potential Proceeds: Up to AED 3.39 billion (~$920 million)

- Selling Shareholder: Mamoura Diversified Global Holding PJSC (Mubadala subsidiary)

- Subscription Period: September 8-12, 2025

- Trading Commencement: September 16, 2025

Company Overview and Market Position

du operates as the second licensed telecommunications operator in the UAE, serving a market characterized by high penetration rates and sophisticated infrastructure. The company has evolved from its initial focus on traditional telecommunications services to become an integrated digital services provider, offering mobile, fixed, wholesale, and ICT services alongside newer ventures in financial technology through du Pay.

The UAE telecommunications market presents unique advantages for du’s operations. The country maintains one of the world’s highest mobile penetration rates at 231% as of 2024, significantly exceeding regional peers like Kuwait (184%), Qatar (172%), and Saudi Arabia (126%). Furthermore, the UAE leads the Middle East in fiber coverage with fiber-to-the-home coverage reaching approximately 99%, creating a robust foundation for advanced service delivery.

Recent Financial Performance (H1 2025)

- Revenue: AED 7.8 billion (+8% YoY)

- EBITDA: AED 3.7 billion (+16% YoY) with 47% margin

- Net Profit: AED 1.4 billion (+22% YoY)

- Operating Free Cash Flow: AED 2.7 billion (+16% YoY)

Market Position Metrics

- Mobile Market Share: 36.0% value share (as of June 2025)

- Fixed Market Share: 27.1% value share (as of June 2025)

- Mobile Subscribers: 9.1 million (+10.8% YoY growth)

- Fixed Subscribers: 706,000 (+12.0% YoY growth)

Offering Structure and Mechanics

Dual-Tranche Architecture

First Tranche (UAE Retail Offer) – 5% Allocation

Target Investors: Individual UAE residents and local entities

- Shares Available: 17,104,204 shares

- Minimum Investment: AED 5,000

- Investment Increments: AED 1,000

- Guaranteed Allocation: Up to 500 shares per subscriber (subject to availability)

- Subscription Timeline: September 8 (9:00 AM) to September 12 (12:00 PM)

Second Tranche (Institutional Offering) – 95% Allocation

Target Investors: Qualified institutional investors globally

- Shares Available: 324,979,880 shares

- Minimum Investment: AED 5,000,000

- Settlement Mechanism: DFM Direct Deals system

- Geographic Scope: UAE and international markets (excluding US retail)

- Settlement Date: September 18, 2025

Pricing and Valuation Framework

The AED 9.00-9.90 price range represents:

- Discount to Recent Trading: 9.1% discount at lower range vs. September 4 closing price

- Final Price Determination: Bookbuilding process concludes September 12

- Price Announcement: September 15, 2025

Subscription Channels and Banking Partners

Lead Financial Institutions

Joint Global Coordinators & Bookrunners:

- Abu Dhabi Commercial Bank PJSC

- Emirates NBD Capital PSC

- First Abu Dhabi Bank PJSC

- Goldman Sachs International

Lead Receiving Bank:

- Emirates NBD Bank PJSC (Contact: 800 3623 476)

Complete Receiving Bank Network

Retail Subscription Channels:

- Abu Dhabi Commercial Bank PJSC

- Abu Dhabi Islamic Bank PJSC

- Al Maryah Community Bank LLC

- Dubai Islamic Bank PJSC

- Emirates Islamic Bank PJSC

- First Abu Dhabi Bank PJSC

- Wio Bank PJSC

Digital Subscription Platforms

DFM E-Subscription Services

- Platform: www.dfm.ae, DFM mobile app, iVESTOR app

- Payment Methods: iVESTOR Card, UAE Central Bank Payment Gateway (UAEPGS)

- Cutoff: Available until September 12, 12:00 PM

Bank-Specific Digital Channels

Emirates NBD:

- Online banking and mobile app

- Dedicated IPO portal: https://ipo.emiratesnbd.com/en

- ATM subscription capability

- Support: 800 ENBD IPO (800 3623 476)

ADCB:

- Subscription portal: https://www.adcb.com/du

- UAE Pass authentication supported

- Customer ID and mobile verification required

FAB:

- Online platform: https://www.bankfab.com/en-ae/cib/iposubscription

- FAB mobile banking integration

- Support: 026161800

Additional Digital Channels:

- Dubai Islamic Bank: WhatsApp subscription (+97146092222)

- Wio Bank: In-app subscription with instant NIN generation

- Al Maryah Bank: Mobile app with leverage options (Contact: 600571111)

Payment Mechanisms and Settlement

First Tranche Payment Options

- Certified Bank Cheque: Payable to ‘du-FMO’ (Deadline: September 10, 2:00 PM)

- Account Debit: Direct debit from Receiving Bank accounts

- Electronic Transfers: UAEPGS, FTS, SWIFT (Deadline: September 11, 2:00 PM)

- Digital Platforms: ATM, internet banking, mobile apps (Deadline: September 12, 12:00 PM)

Second Tranche Settlement Process

- Mechanism: DFM Direct Deals system through authorized brokers

- Investor Requirements: Pre-arranged broker relationships with fee agreements

- Settlement Basis: Delivery versus payment (T+2 standard)

- Trading Commencement: September 16, 2025

Shareholder Structure and Ownership Changes

Current Ownership (Pre-Offering)

- Emirates Investment Authority: 50.12% (Federal sovereign fund)

- DH 8 LLC: 19.66% (Dubai Holding subsidiary)

- Mamoura Diversified Global: 10.06% (Mubadala subsidiary)

- Public Shareholders: 20.16%

Post-Offering Structure (Assuming Full Subscription)

- Emirates Investment Authority: 50.12% (unchanged)

- DH 8 LLC: 19.66% (unchanged)

- Mamoura Diversified Global: 2.52% (reduced from 10.06%)

- Public Shareholders: 27.70% (increased from 20.16%)

Strategic Investment Rationale

Growth Drivers and Market Positioning

UAE Digital Economy Tailwinds

- GDP Growth Projection: 4.0% (2025), averaging 4.7% through 2027

- Digital Economy Target: Double contribution to 20% of GDP by 2031

- Population Dynamics: Growth from 1M (1980) to 10.7M (2023), targeting 11.5M by 2030

- Demographics: 79% of population under 44 years old

Competitive Positioning

- Market Structure: Duopoly with e& (formerly Etisalat)

- Revenue Growth: 7.1% CAGR (2022-2024)

- Market Share Expansion: Mobile value share increased from 33.0% to 36.0% (2021-2025)

- Fixed Market Growth: Value share expanded from 20.3% to 27.1% (2021-2025)

Adjacent Business Expansion

- du Pay Fintech: 500,000+ downloads, AED 800M+ transactions processed

- du Tech ICT Services: Hyperscale data center development with Microsoft

- Infrastructure Investments: AED 2 billion committed to data center expansion

Financial Performance Metrics

Profitability Enhancement (2022-2024)

- EBITDA Growth: 12.2% CAGR, margin expansion from 40.3% to 44.2%

- Net Profit Growth: 42.8% CAGR, margin improvement from 9.6% to 17.0%

- Operating Free Cash Flow: AED 4.4 billion (2024), 22.8% increase YoY

Shareholder Returns Track Record

- Dividend History: Uninterrupted payments since 2012

- 2024 Dividend: AED 0.54 per share (+58.8% YoY, 98% payout ratio)

- Dividend CAGR: 50.0% (2022-2024)

- Capital Allocation: 68.4% cash conversion rate (2024)

Risk Assessment and Market Considerations

Risk Assessment and Considerations

Investors should consider several risk factors when evaluating du’s investment proposition. Technology evolution risks remain significant in the telecommunications sector, with rapid changes in network standards, customer preferences, and competitive dynamics requiring continuous capital investment and strategic adaptation. du’s substantial reliance on Huawei for critical infrastructure components creates potential supply chain and regulatory risks, particularly given ongoing geopolitical tensions affecting this vendor.

Market saturation in core telecommunications services presents growth challenges, though du has demonstrated success in expanding into adjacent services and capturing market share. Economic sensitivity represents another consideration, as consumer and enterprise spending on telecommunications services can be affected by broader macroeconomic conditions, though the UAE’s economic stability and diversification efforts provide some insulation.

Regulatory changes could impact du’s operating environment, including potential modifications to licensing terms, royalty obligations, or market structure. However, the UAE’s commitment to telecommunications infrastructure development and digital transformation initiatives generally supports the sector’s long-term prospects.

Regulatory and Compliance Framework

Securities Regulation Compliance

- Primary Regulator: Securities and Commodities Authority (SCA)

- Prospectus Approval: August 28, 2025 (Reference: 2025/309/KH/ESH)

- Shariah Compliance: Confirmed by Emirates NBD and FAB Shariah committees

- Foreign Ownership: Up to 49% permitted for non-UAE nationals

Lock-up Provisions

- Mamoura Lock-up: 90-day restriction on remaining shares post-settlement

- Exceptions: Subject to Joint Global Coordinator consent

- Scope: Applies only to unsold portion of Mamoura’s holdings

Investment Process and Timeline

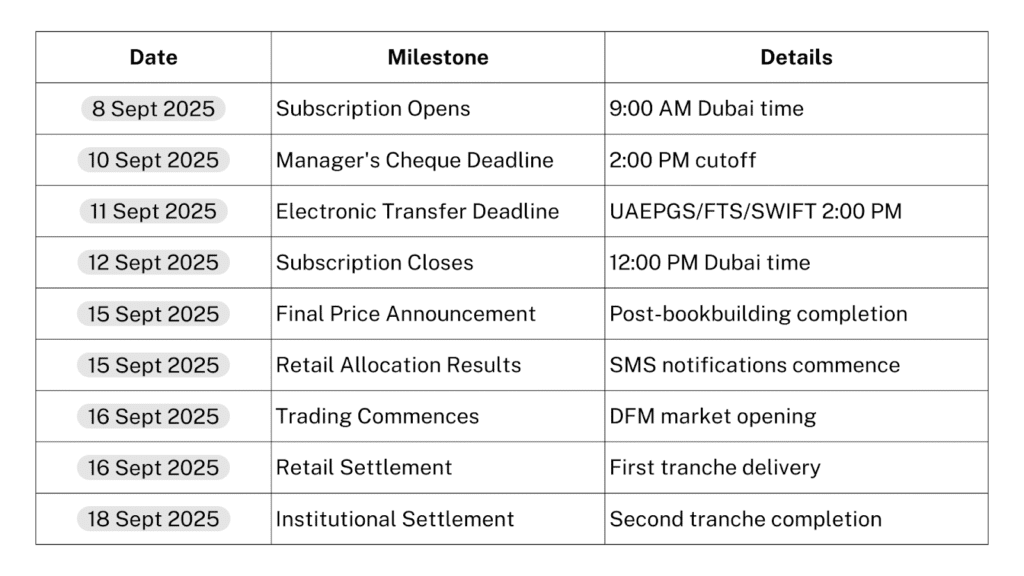

Critical Dates Calendar

Subscription Process Requirements

Documentation for Individual Investors

- UAE/GCC Nationals: Emirates ID or passport, NIN details

- Other Nationals: Valid passport, NIN registration

- Representatives: Notarized power of attorney, signatory documentation

- Minors: Guardian documentation, court-appointed guardianship certificates

Institutional Investor Requirements

- UAE Entities: Trade license, authorized signatory documentation, NIN registration

- Foreign Entities: Jurisdiction-specific documentation, regulatory compliance certificates

- Investment Firms: Professional investor status verification

Market Impact and Strategic Implications

Capital Market Development

- Free Float Enhancement: Increase from 20.16% to 27.70% improves liquidity

- Index Inclusion Potential: Enhanced eligibility for international indices

- Benchmark Transaction: Sets precedent for UAE secondary offerings

- Market Depth: Expanded institutional investor base

Sector Implications

- Valuation Benchmark: Price discovery for regional telecom assets

- Liquidity Premium: Enhanced trading volumes expected

- Corporate Governance: Improved transparency and reporting standards

- Strategic Flexibility: Reduced concentrated ownership structure

Investment Recommendation Framework

Buy-Side Considerations

Positive Factors:

- Strong financial performance with consistent growth trajectory

- Dominant market position in resilient telecommunications sector

- Successful diversification into high-growth adjacent markets

- Attractive dividend yield with progressive payout policy

- UAE macro environment supporting digital transformation

Risk Mitigation Factors:

- Established regulatory framework with predictable licensing environment

- Diversified revenue streams reducing traditional telecom dependencies

- Strong balance sheet supporting growth investments and shareholder returns

- Experienced management team with proven execution capabilities

Institutional Allocation Strategy

Target Investor Profile:

- Regional telecommunications specialists

- Emerging market dividend-focused funds

- Infrastructure and utility investors

- UAE/GCC regional equity funds

- ESG-conscious institutional investors

Documentation and Legal Framework

Key Documents

- English Prospectus: Available at www.du.ae/secondary_public_offering

- International Offering Memorandum: Institutional investor document

- Shariah Compliance Certificates: Emirates NBD and FAB endorsements

- Financial Statements: Audited results through H1 2025

- Risk Disclosures: Comprehensive operational and market risk analysis

Legal Counsel

- Company UAE Counsel: Al Tamimi & Company Ltd.

- Company International Counsel: Linklaters LLP

- Selling Shareholder Counsel: Clifford Chance LLP

- Joint Lead Managers Counsel: White & Case LLP

Market Outlook and Future Catalysts

Growth Catalysts

- 5G Network Expansion: Advanced coverage supporting new service offerings

- Data Center Development: Microsoft partnership and hyperscale facility construction

- Fintech Expansion: du Pay platform scaling across UAE market

- Government Digitalization: Smart city initiatives creating enterprise demand

- Tourism Recovery: International visitor growth supporting roaming revenues

Strategic Initiatives

- Technology Partnerships: Oracle Alloy, Microsoft Azure integration

- Infrastructure Investment: Fiber network expansion, 5G densification

- Adjacent Market Entry: Cloud services, cybersecurity, IoT solutions

- Operational Excellence: Digital transformation and automation programs

This analysis is based on publicly available information as of September 2025. Investors should conduct independent due diligence and consult the official prospectus before making investment decisions.

Disclaimer: This document is for informational purposes only and does not constitute investment advice. Past performance does not guarantee future results. All investments carry risk of loss.