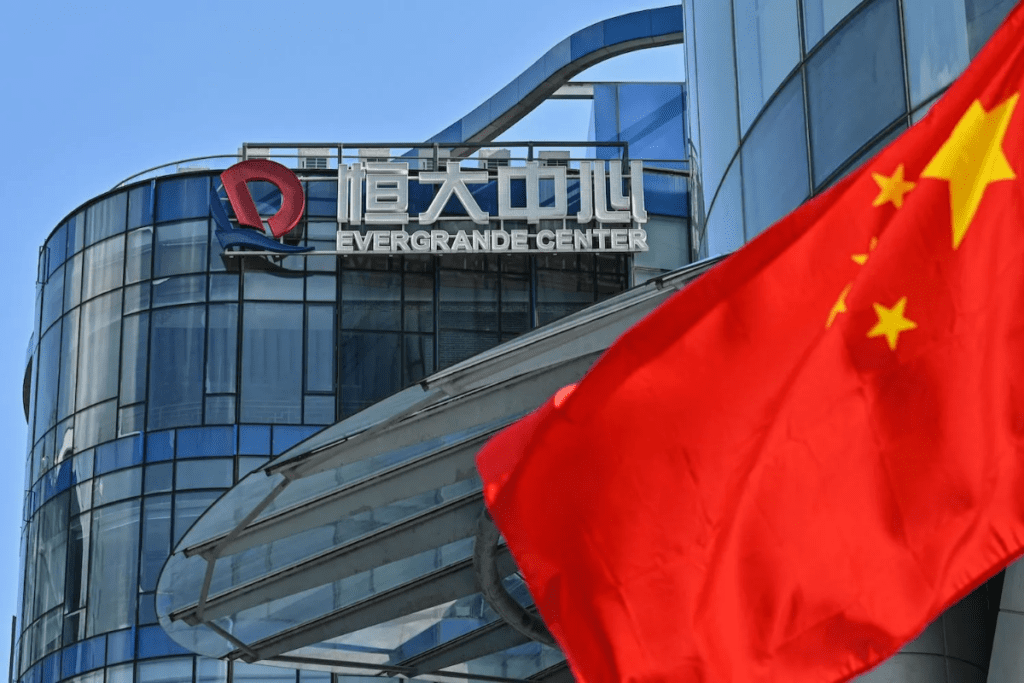

China-based property developer had payments worth $255m due this week.

On Thursday, shares of China Evergrande Group fell after the heavily indebted developer did not pay offshore coupons due this week.

Evergrande, whose $19 billion in international bonds are in cross-default after missing a deadline to pay coupons this month, had new coupon payments worth $255 million due on Tuesday for its June 2023 and 2025 notes.

Some holding the two bonds have not yet received the coupons, according to sources. Both the payments have a 30-day grace period.

Evergrande’s shares were down 9.7 per cent at HK$1.49 at 07:07am UAE time, while the Hang Seng index was up 0.5 per cent.

Bloomberg News reported that the due date passed with no sign of payment by the property developer.

Evergrande’s Thursday decline wiped out gains from earlier this week, when the market cheered the initial progress made by the firm in resuming construction work.

On Sunday, chairman Hui Ka Yan vowed to deliver 39,000 units of properties in December, compared with fewer than 10,000 in each of the previous three months.

“[The non-payments] show Evergrande is still not doing OK even though it is delivering homes,” said Thomas Kwok, head of equity business of Chef Securities in Hong Kong.

The market confidence in Evergrande and the China property sector is weak as there could be more defaults with many bonds due in January, Mr Kwok said.

Evergrande has more than $300bn in liabilities and is hurrying to raise cash by selling assets and shares to repay suppliers and creditors.

The fate of Evergrande and other indebted Chinese property companies has gripped financial markets in recent months as investors fear knock-on effects, with Beijing repeatedly seeking to reassure.

(Except for the headline, this story has not been edited by The Finance World staff and is published from a syndicated feed.)