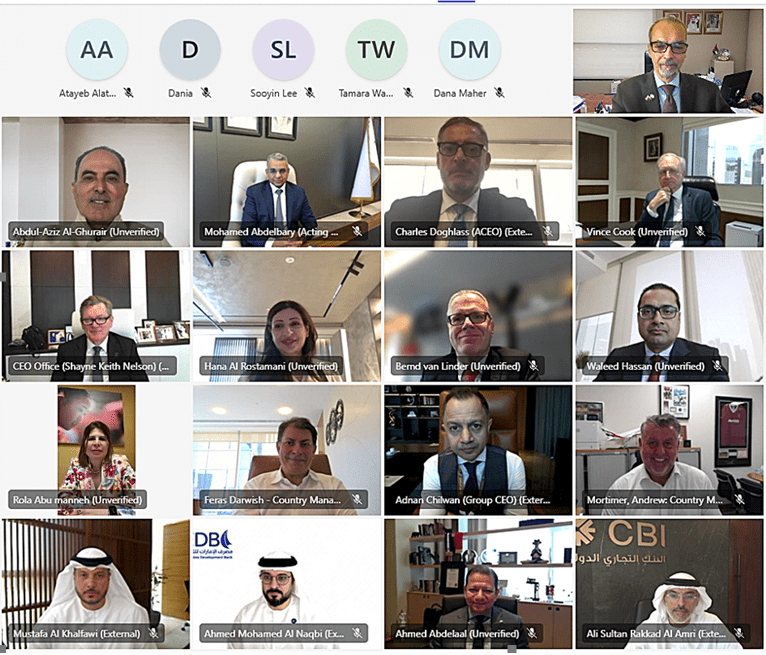

The CEOs Advisory Council of the UAE Banks Federation (UBF), the sole representative and unified voice of UAE banks, held its second regular meeting of 2024 yesterday (24th June) under the chairmanship of His Excellency Abdulaziz Al-Ghurair, Chairman of the Board of Directors of UAE Banks Federation, to discuss the latest advancements and key developments in the banking and finance sector and review progress in the implementation of initiatives. The meeting also discussed plans to achieve Federation’s strategic goals and plans for this year.

The meeting praised the achievements of the banking sector and the initiatives implemented by the Federation in the past months of this year to improve banking services for various customer segments. Additionally, the meeting highlighted the continued role of the sector in the economic development of the country under the direct supervision of the Central Bank of the UAE. Furthermore, the participants recognized the significant progress made in enhancing service delivery and driving economic growth.

H.E. Abdulaziz Al-Ghurair, said: “The banking sector continues its strong performance and growth with solid financial and investment indicators, keeping pace with the rapid developments in the global economy. This confirms the effectiveness and success of the UAE Central Bank’s strategies and policies in creating a conducive environment for the banking and financial sector to thrive and fulfil its role in the economic system.”

“The CEOs Advisory Council of the Federation contributes to the development of the financial sector as it is composed of leaders with extensive experience and insightful knowledge and provides an important platform to address and discuss important issues in order to provide the necessary recommendations for decision making for UBF whose efforts are focused on ensuring a smooth and secure banking experience for customers, building a solid foundation for the sector and taking advantage of opportunities offered by the UAE economy to consolidate the UAE’s position among the most prominent global financial, economic and commercial centres,” he added.

The participants at the meeting emphasised that the strong performance of the banking sector is a catalyst for sustained growth. They pointed out that the banking sector’s total assets exceeded AED 4.25 trillion at the end of the first quarter of this year, reflecting the high level of confidence in the banking sector.

According to the latest statistics from Central Bank of the UAE, the total bank credit increased to AED 2.04 trillion by the end of March 2024, deposits rose to AED 2.657 trillion in the same period and the total amount of assets rose to AED 4.25 trillion.

The CEOs Advisory Council called for redoubling efforts to achieve the Federation’s strategic priorities, focusing on the goals of Emiratisation in the banking and financial sector, sustainability and governance, and enhancing financial inclusion and supporting small and medium enterprises. The council stressed the importance of attracting and nurturing Emirati talent and increasing their participation in the banking and financial sector in line with the directives of Central Bank of the UAE.

Participants at the meeting praised the initiatives of the UAE Banks Federation and its member banks to accelerate digital transformation through the development of digital infrastructure, keeping abreast with the latest solutions and innovations, improving cyber security, and raising awareness on financial crime and combating advanced fraud methods, which are a key element in ensuring security in the sector.

The CEOs Advisory Board also noted the role that the UAE Banks Federation plays in consolidating the integrity of the financial system under the direct supervision of Central Bank of the UAE by working to ensure that all UBF members comply with laws, regulations and supervisory guidelines and adhere to the highest standards of corporate governance, transparency and risk management.

Mr. Jamal Saleh, Director General of UBF, said: “The banking and financial sector continues to develop and consolidate its leading position under the direct supervision of Central Bank of the UAE. We at UBF are keen to strengthen cooperation with all strategic partners in the country to further develop and keep pace with the rapid advancements in the sector while ensuring adherence to the highest standards of regulations and compliance. In this context, our CEOs Advisory Council plays an important role by supporting the Federation’s General Secretariat and its specialised technical and advisory committees with advice, opinions and consultations. All this helps to enhance the Federation’s initiatives and plans to develop the banking sector and provide appropriate services and products to customers, which strengthens our ability to support the UAE in achieving its development and economic goals.”