Starting 1 January 2026, the UAE will implement a tiered sugar tax on beverages containing more than five grams of sugar per 100 millilitres. This initiative aims to encourage healthier consumption habits and support public health across the community. As a result, sugary drinks may now cost more at the point of purchase, with taxes ranging from AED0.79 to AED1.09 per litre depending on sugar content.

The amendment follows a broader GCC approach, with Saudi Arabia also planning to introduce sugar levies from the same date, though details are yet to be announced. Cabinet Decision No. 197 of 2025, issued by the Ministry of Finance, replaces the earlier 2019 resolution on excise goods, providing updated tax rates and a clear framework for selective goods.

Tax Rates and Exemptions

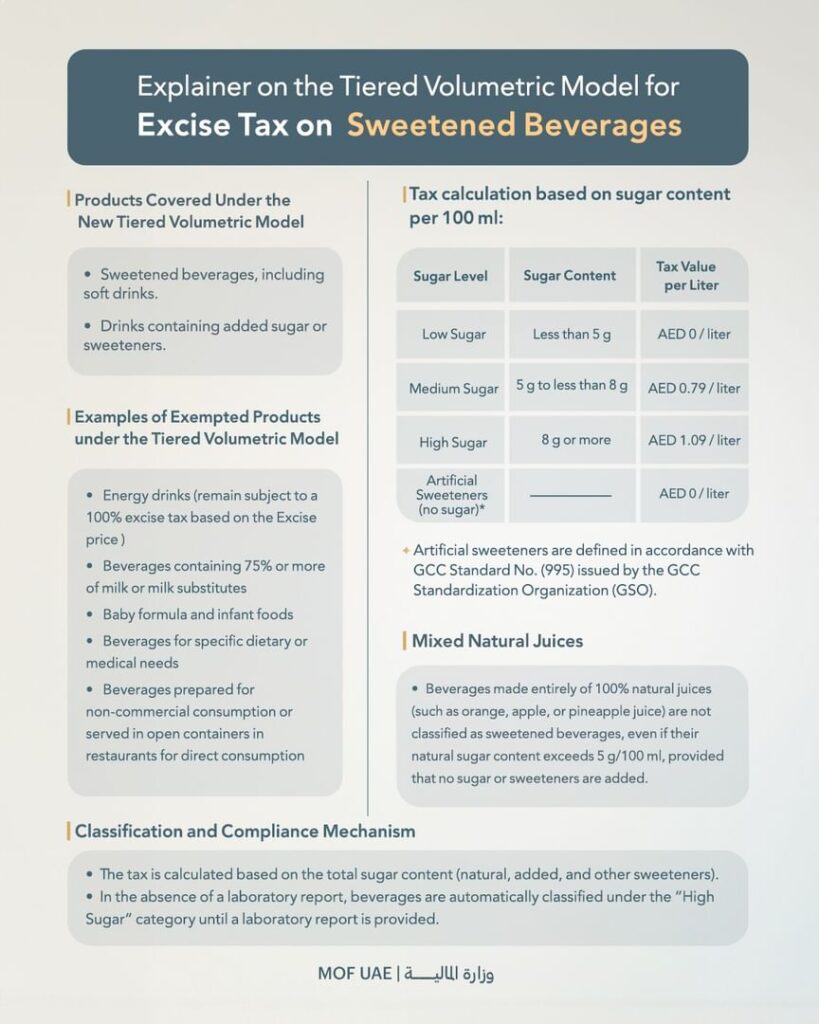

Under the new system, beverages containing between five and eight grams of sugar per 100ml will be taxed at AED0.79 per litre. Meanwhile, drinks with eight grams or more per 100ml will incur a higher tax of AED1.09 per litre. Conversely, beverages with less than five grams of sugar per 100ml, as well as those containing only artificial sweeteners, are exempt.

This tiered volumetric approach ensures that taxes reflect sugar content, creating a stronger incentive for both producers and consumers to reduce sugar levels in drinks. Consequently, it encourages healthier alternatives while maintaining a straightforward compliance framework for businesses.

Implementation and Compliance Procedures

To facilitate smooth enforcement, the decree establishes a unified legislative framework, clearly defining excise goods, applicable tax rates, and the Federal Tax Authority’s procedures for classifying products. If taxable persons fail to submit the required laboratory reports or supporting documentation, the tax will be applied according to the highest sugar category. It may later be adjusted once an approved laboratory report is submitted.

The Ministry highlighted that, besides promoting public health, these taxes aim to lower financial burdens linked to sugar-related diseases. Therefore, consumers and producers alike are expected to adapt their habits and offerings, contributing to a healthier and more sustainable community.